Why Personal Finance Feels Like a Secret Club

Personal finance is often presented as simple: earn money, save some, invest wisely, and avoid debt. Yet despite this seemingly straightforward formula, many people struggle financially for decades, while a smaller group steadily builds wealth and financial freedom. The difference is not just income—it is knowledge, mindset, and strategy.

This article reveals the secrets of personal finance the rich won’t tell you. These are not illegal tricks or overnight schemes. They are quiet, disciplined, long-term principles that wealthy individuals use consistently but rarely explain openly. By the end of this guide, you will understand how money truly works, how wealth is built over time, and how you can apply the same principles regardless of your current income.

1. The First Secret: Wealth Is Built on Mindset, Not Money

Most people believe wealth starts with money. The rich know it starts with mindset.

How the Wealthy Think Differently

- They see money as a tool, not a goal

- They focus on long-term outcomes, not short-term comfort

- They ask, “How can this money grow?” instead of “What can I buy?”

A person with a strong financial mindset can lose everything and rebuild. A person without it can win the lottery and still go broke.

Action You Can Take

- Replace “I can’t afford it” with “How can I afford it?”

- Think in decades, not months

- Treat financial education as a lifelong skill

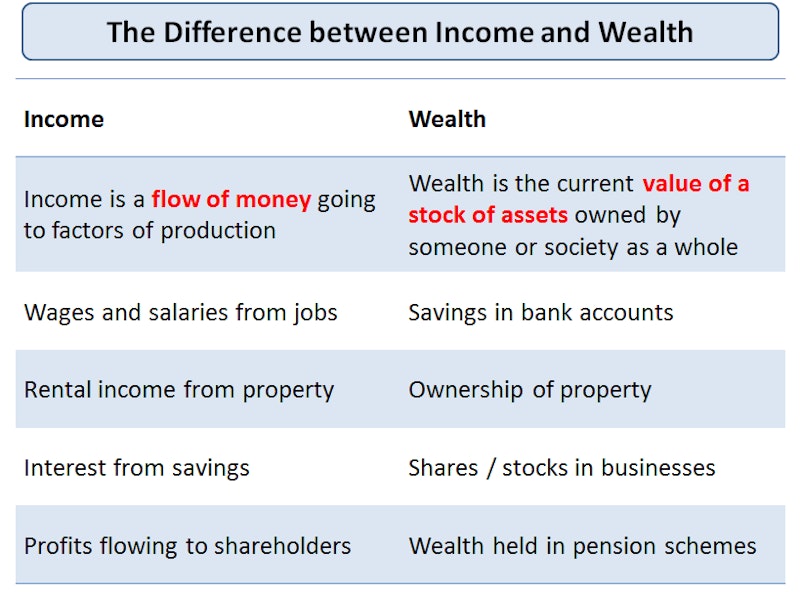

2. The Income Illusion: Why High Salaries Don’t Create Wealth

One of the biggest secrets is this: high income does not equal wealth.

Many high earners live paycheck to paycheck due to lifestyle inflation. As income rises, expenses rise even faster.

The Rich Focus on Cash Flow

Wealthy individuals prioritize:

- Positive cash flow

- Income-producing assets

- Reducing dependency on a single paycheck

They do not rely on one source of income. They build systems that earn money even when they are not working.

3. Budgeting Like the Wealthy (It’s Not What You Think)

The rich do not budget to restrict life—they budget to control direction.

The Wealthy Budgeting Rule

Instead of tracking every dollar obsessively, they:

- Automate saving and investing first

- Spend what remains guilt-free

- Review finances monthly, not daily

This approach removes emotion from money decisions and builds consistency.

4. The Power of Paying Yourself First

One of the oldest yet most ignored principles of wealth building is paying yourself first.

What This Means

Before paying bills, entertainment, or lifestyle costs:

- A percentage goes directly into savings

- Another portion goes into investments

The rich automate this process so discipline is no longer required.

5. The Debt Secret: Not All Debt Is Bad

Many people are taught to fear all debt. The wealthy understand leverage.

Two Types of Debt

Bad Debt

- Consumer loans

- High-interest credit cards

- Depreciating purchases

Strategic Debt

- Assets that generate income

- Opportunities that grow wealth

- Controlled and calculated risk

The key is discipline and education, not avoidance.

6. Assets vs Liabilities: The Rule That Changes Everything

This is one of the most important financial truths:

If it puts money in your pocket, it’s an asset. If it takes money out, it’s a liability.

Many people mistakenly believe expensive items are assets when they are actually liabilities.

Wealthy Strategy

- Buy assets first

- Use asset income to fund lifestyle

- Delay gratification strategically

7. Why the Rich Obsess Over Financial Education

The wealthy invest heavily in knowledge.

They read books, attend seminars, hire advisors, and continuously learn about:

- Markets

- Taxes

- Business structures

- Investments

Financial education compounds just like money.

8. The Silent Growth of Compound Interest

Compound interest is often called the eighth wonder of the world, yet few truly use it.

Why the Rich Start Early

- Time matters more than amount

- Small investments grow massive over decades

- Consistency beats intensity

Waiting costs more than losing money.

9. Risk Management: How the Rich Protect Wealth

The rich do not avoid risk—they manage it.

Protection Strategies

- Diversification

- Insurance

- Emergency reserves

- Legal and structural planning

Protection ensures one mistake doesn’t erase decades of progress.

10. Taxes: The Quiet Wealth Killer

Taxes are often the largest expense people never plan for.

What the Rich Do Differently

- Plan taxes in advance

- Structure income efficiently

- Understand rules instead of fearing them

Legal tax planning is not cheating—it’s intelligence.

11. Lifestyle Design Over Lifestyle Inflation

Wealth is not about excess—it is about choice.

The rich design lives where money supports happiness, not stress.

12. The Truth About Financial Freedom

Financial freedom is not about never working. It is about:

- Freedom of time

- Freedom of choice

- Freedom from financial fear

It is built slowly, quietly, and intentionally.

13. Common Lies About Money You Must Unlearn

Some of the most damaging beliefs include:

- “Money is evil”

- “Rich people are greedy”

- “I’ll start later”

The rich question beliefs before accepting them.

14. How to Apply These Secrets in Real Life

Simple Action Plan

- Track your cash flow

- Automate savings and investments

- Educate yourself monthly

- Reduce bad debt

- Acquire income-producing assets

Small actions done consistently create massive results.

Conclusion: Wealth Is Quiet, Simple, and Intentional

The biggest secret of personal finance is that wealth is not dramatic. It does not require luck, fame, or extreme intelligence. It requires:

- Patience

- Discipline

- Education

- Time

The rich do not know something magical—they simply apply principles most people ignore.

If you start today, your future financial self will thank you.